We manage a transparent, high-conviction strategy engineered to harness volatility and deliver exceptional long-term growth.

Invest with conviction. Grow with discipline.

About JPAG Risk Capital

At JPAG Risk Capital, we manage a single, high-conviction investment strategy designed to turn volatility into long-term growth.

Our process blends quantitative precision, risk management discipline, and human insight—built over years of market experience.

We believe in clarity over complexity and results over noise.

Our framework is simple: protect capital through disciplined risk control and allow compounding to work through cycles of volatility.

Every decision is data-driven, every position has intent, and every client shares one principle with us—growth through discipline.

Founder Bio

Juan Pablo Arizmendi

Managing Partner, JPAG Risk Capital LLC

Juan Pablo Arizmendi is the founder and managing partner of JPAG Risk Capital LLC, a U.S.-based hedge fund specializing in Nasdaq-focused, volatility-harvesting strategies.

He built JPAG around a simple principle — that clarity, discipline, and asymmetric positioning can compound far more effectively than traditional diversification.

Before launching JPAG, Juan Pablo worked in management consulting, advising leading corporations across Latin America on financial strategy and performance optimization. His work bridged analytical precision and behavioral insight, helping clients navigate uncertainty and complex decision environments.

Experiences operating under extreme pressure shaped a disciplined, risk-first investment philosophy.

Today, JPAG Risk Capital stands as a reflection of that mindset: resilient, adaptive, and committed to asymmetric excellence in every market environment.

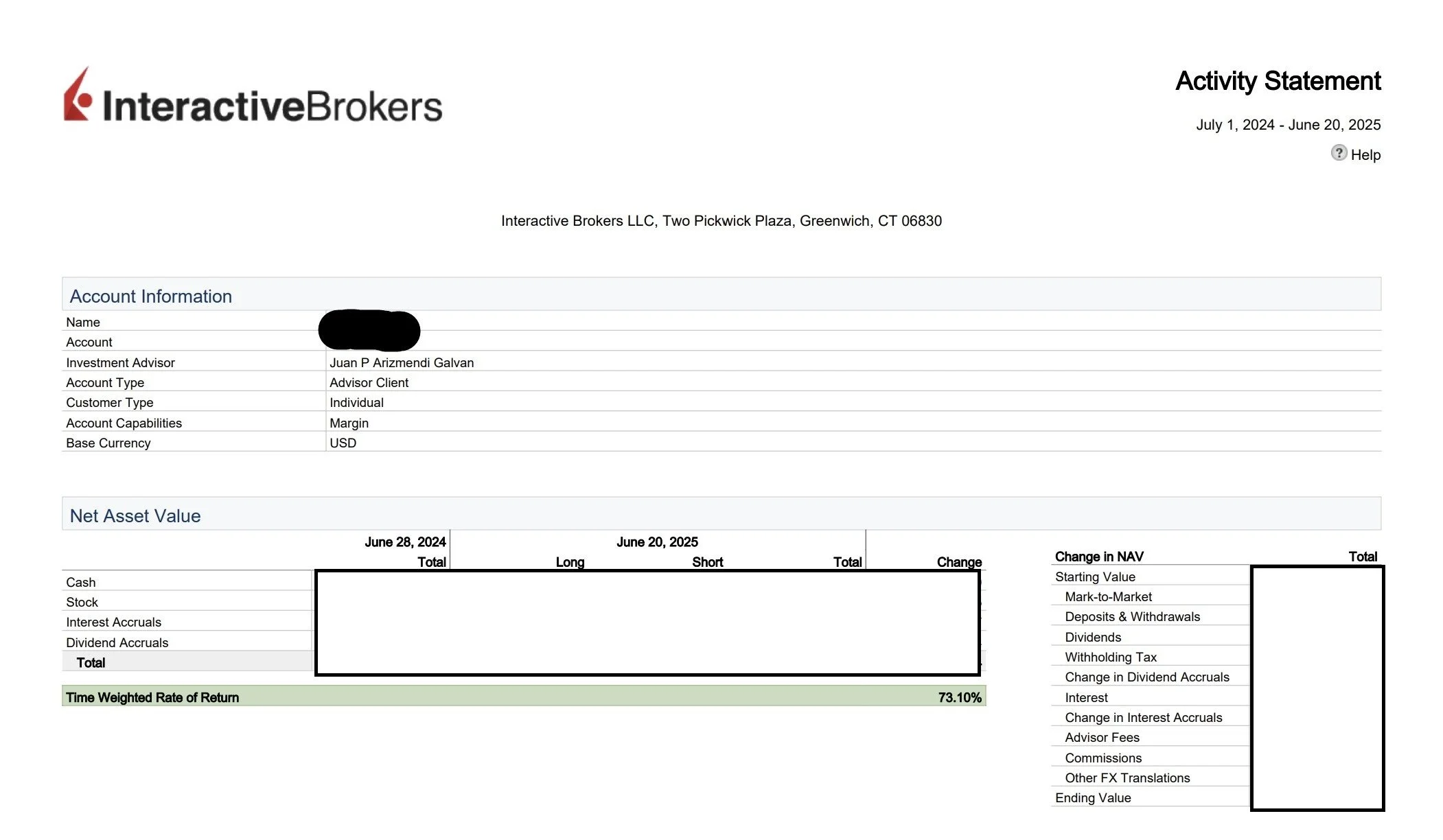

Performance & Transparency: We measure results through data, not promises

Client assets are custodied at Interactive Brokers, an independent 3rd party Custodian and Prime Broker

At JPAG Risk Capital, transparency is at the core of our investment philosophy.

Every figure you see is backed by third-party brokerage data and reflects our real performance—not simulated results.

The strategy has demonstrated consistent asymmetric return characteristics across multiple market regimes. Performance data is reviewed with qualified investors in private discussions.

Our focus is simple: preserve capital, compound asymmetrically, and stay accountable through every market cycle.

Past performance is not indicative of future results

Investment Strategy

Harnessing volatility. Compounding discipline.

At JPAG Risk Capital, we focus exclusively on the Nasdaq-100 index, applying a systematic volatility-harvesting framework designed to capture asymmetric returns in both rising and falling markets.

Our approach integrates:

Directional exposure through long and short index positions.

Dynamic leverage adjustment to increase exposure when opportunity density is highest.

Quantitative discipline guided by real-time risk analytics and structural volatility signals.

The result is a strategy engineered to deliver high long-term growth with controlled downside, turning volatility—the enemy of most investors—into our core compounding engine.

In a world of uncertainty, discipline becomes the most powerful alpha.

FAQ

What is the minimum investment amount?

The minimum investment in our core high-conviction investment strategy is $250,000 USD.

To comply with regulations, eligibility to participate in the strategy is subject to complying with the SEC´s qualified client standards.

How can I monitor the performance of my investments?

Capital allocated to the strategy is held at Interactive Brokers, our independent custodian and prime broker.

You can monitor your portfolio 24/7 through the Interactive Brokers mobile app or web portal, where you’ll see positions, performance and trade history in real time. JPAG Risk Capital also provides periodic strategy reports that summarize performance and risk.

What safeguards exist for my funds?

All assets are custodied at Interactive Brokers in the name of the Fund. JPAG Risk Capital has trading-only authority and cannot withdraw or transfer funds out of the custodian. Investor capital accounts are administered independently, and statements are provided directly by the custodian and the fund administrator.

Let´s connect

If the strategy outlined aligns with your objectives and you meet the SEC’s qualified client criteria, we invite you to connect.

You may reach out using the form to the right or directly through the contact details at the bottom of this page.

We look forward to exploring how our framework can help you achieve disciplined, long-term growth.

For qualified clients seeking alignment, you may schedule a confidential introductory call below:

JPAG Risk Capital LLC works with a small number of aligned, long term partners. Inbound inquiries are reviewed selectively.